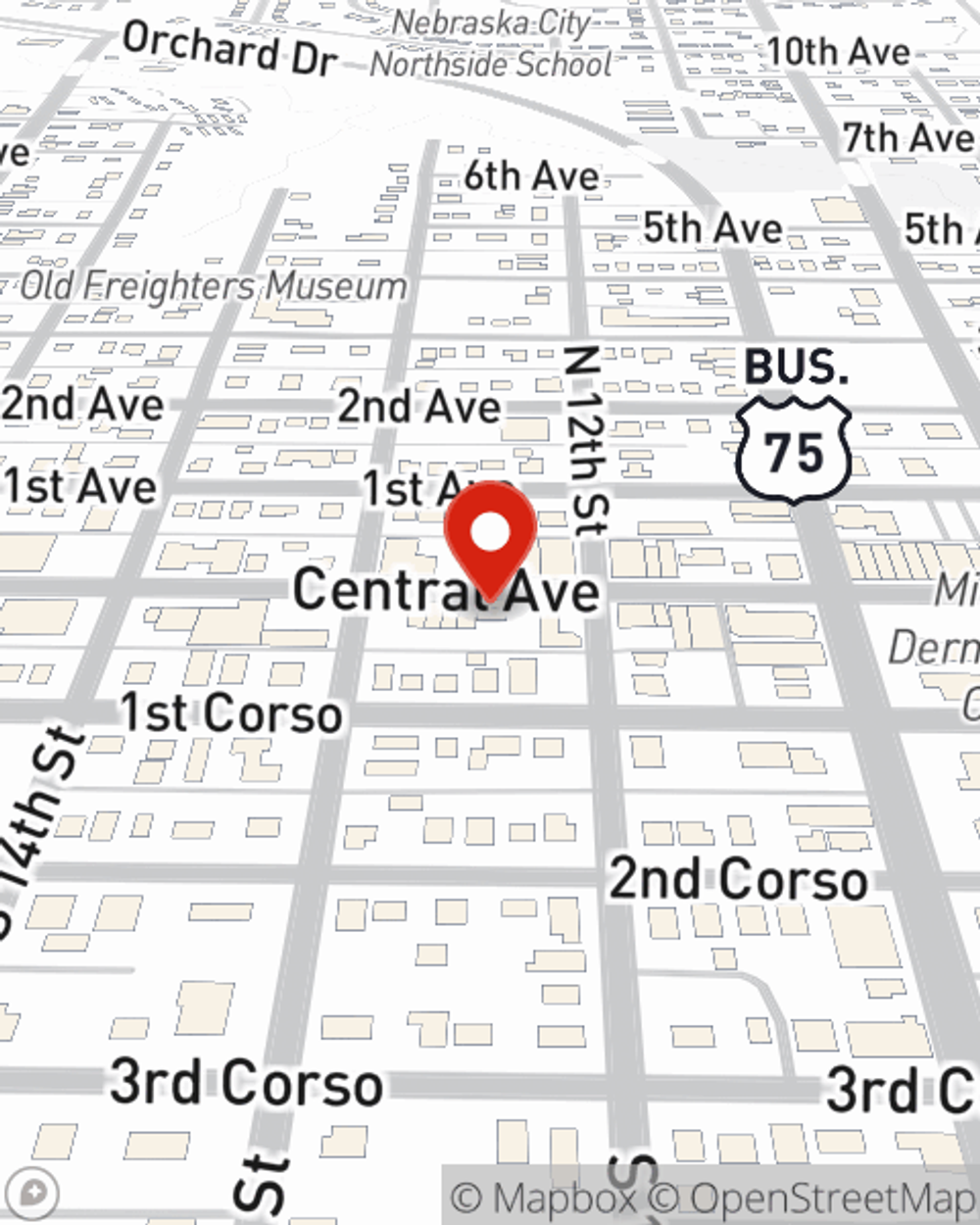

Business Insurance in and around Nebraska City

One of Nebraska City’s top choices for small business insurance.

Helping insure small businesses since 1935

- Nebraska

- Iowa

- Missouri

- Kansas

- Southeast Nebraska

- Otoe County

- Cass County

- Nemaha County

- Johnson County

- Nebraska City

- Syracuse

- Dunbar

- Palmyra

- Talmage

- Otoe

- Unadilla

- Cook

- Avoca

- Weeping Water

- Louisville

- Elmwood

- Auburn

- Tecumseh

- Hamburg

Cost Effective Insurance For Your Business.

Whether you own a a cosmetic store, a stained glass shop, or a toy store, State Farm has small business protection that can help. That way, amid all the various options and moving pieces, you can focus on making this adventure a success.

One of Nebraska City’s top choices for small business insurance.

Helping insure small businesses since 1935

Customizable Coverage For Your Business

When one is as committed to their small business as you are, it makes sense to want to make sure everything has been thought of. That's why State Farm has coverage options for artisan and service contractors, business owners policies, commercial auto, and more.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Eric Ford is here to help you review your options. Reach out today!

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Eric Ford

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.